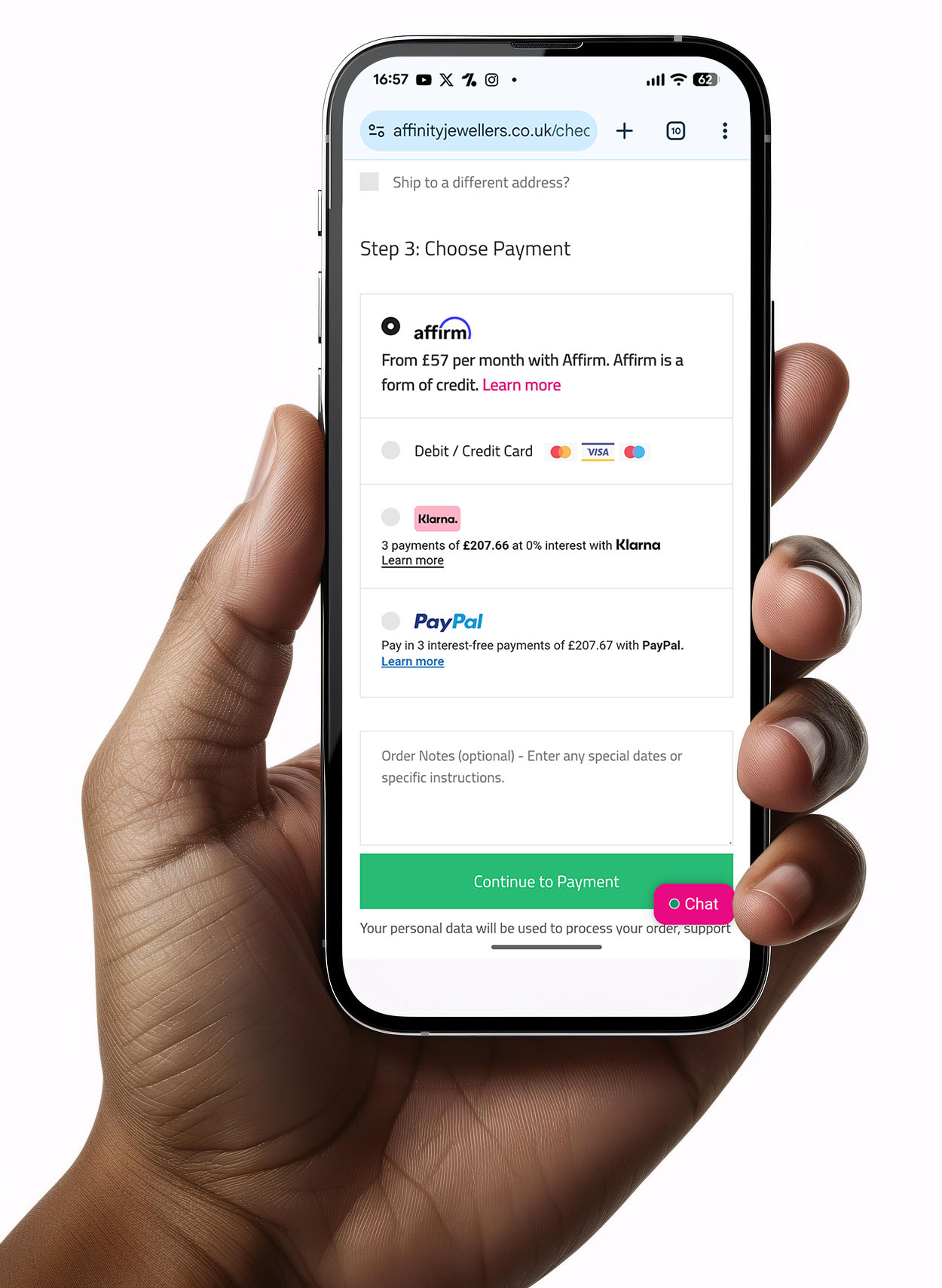

Pay over time.

Select Affirm at checkout to choose a payment plan that fits your budget.

Shopping with Affirm is easy

Step 1 - Fill your basket

Just select Affirm at checkout and enter a few details for a real-time decision. Seeing if you qualify for an Affirm fixed sum loan will not affect your credit rating.

Step 2 - Choose how to pay

Select the payment plan that works for you.

Step 3 - Pay over time

Set up AutoPay, manage your account online and enjoy your purchase.

Representative example: A £900 purchase might cost £75.00/mo over 12 months at 22% Representative APR. A down payment may be required.

Why use Affirm?

Transparent

Affirm tells you the total amount you'll pay up front. The number will never go up

Flexible

You choose the payment schedule that works for you

Fair

Affirm doesn't charge late fees or hidden fees of any kind, ever.

Why use Affirm?

Transparent

Affirm tells you the total amount you'll pay up front. The number will never go up

Flexible

You choose the payment schedule that works for you

Fair

Affirm doesn't charge late fees or hidden fees of any kind, ever.

Frequently Asked Questions

-

How do Affirm eligibility checks and credit worthiness assessments work?

As part of the eligibility check and creditworthiness assessment, Affirm contacts the credit reference agencies, but this will not affect your credit rating or be seen by any other lender. We may ask you some questions about your personal circumstances and consider multiple factors to make a decision if our product will work for you and is financially sustainable. Even if you've passed our eligibility check and creditworthiness assessment, we reserve the right to refuse any application or to refuse a loan for certain purposes.

-

Will Affirm impact my credit rating?

When creating an Affirm account and seeing if you qualify, a soft credit check is performed. Checking your eligibility won't affect your credit rating. If you decide to buy with Affirm, these things may affect your credit rating: making a purchase with Affirm, your payment history with Affirm, how much credit you've used, and how long you've had credit.

-

Am I eligible to use Affirm?

To check your eligibility to use Affirm, you'll need:

- To be 18 years of age or over

- To be a resident of the United Kingdom

- A valid UK Driving Licence or Passport

- A UK bank account which supports direct debit or a debit card

- An SMS-capable UK phone number

- To meet the minimum cart size required to use Affirm at checkout.

-

Does Affirm charge interest and fees?

Fees - We don’t charge any fees. That means no late fees, no prepayment fees, no annual fees, and no fees to open or close your account.

Interest - Depending on the size of your purchase and where you're shopping, your payment plan may include interest. You'll never owe more interest than you agree to on day one—so you always know exactly what you're getting into.

A & L Affinity LTD is an Introducer Appointed Representative of Affirm U.K. Limited which is authorised and regulated by the Financial Conduct Authority (Firm Reference Number: 756087). Affirm U.K. Limited provides consumer credit products and is authorised and regulated by the Financial Conduct Authority (“FCA”) for carrying out regulated consumer credit activities (firm reference number 756087). Company number 10199101, with its registered Office is at C/O TMF Group, 1 Angel Court, 13th Floor, London, EC2R 7HJ. Affirm is the trading name of Affirm U.K. Limited. Affirm is a form of credit. Credit subject to credit check. Terms apply. U.K. residents only, 18 and over with a bank account or a debit card. Missed payments could affect your financial status. Representative example: A £900 purchase might cost £75.00/mo over 12 months at 22% Representative APR. A down payment may be required. A & L Affinity LTD is the Introducer Appointed Representative. Affirm UK Limited, 1 Angel Court, 13th Floor, London, EC2R 7HJ is the Lender.